Your True Partner for Payment Solutions

Nilon empowers businesses with payment gateway solutions and improves revenue channels for merchants.

Your True Partner for Payment Solutions

Nilon empowers businesses with payment gateway solutions and improves revenue channels for merchants.

Nilon

Quick and Secure Payment Platform

Partner with us and benefit from our payment pioneers, customizable payment solutions, and a dedicated support team to drive your business to new heights.

Nilon Payment Gateway is designed to help you accept payments in the way that works best for your business.

Empowering your customers with the latest payment technology for an enhanced payment experience.

Payment Acceptance

Making it simple for all users to accept payments with omnichannel flexibility, developer-friendly APIs, pre-built payment plugins, a hosted payment page, and more.

Online Payments

Mobile Payments

QR Code Payments

Paylinks

Hosted Payment Page

Digital Wallets

Our Trusted Partners

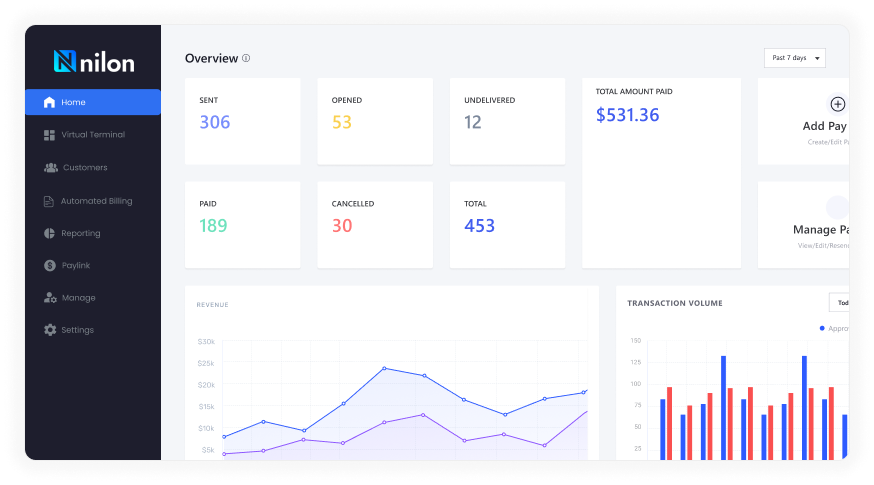

Optimized Payment Features

Our Offerings, Solutions and Resources

Nilon takes control of every aspect of your payment needs and puts you ahead of the competition.

Online Payments

Make it easy for your customers to pay

Offer multiple payment methods and modes

Accept payments from multiple channels

Smart Checkout

Multiple checkout plugins, built to integrate into any platform

Easy for your engineering team to integrate

Easy setup, low code, and one-time integration

QR Code Payments

Facilitates instant transactions for acceping payments

Boosts your customer engagement and loyalty

Convenient and modern payment options

Payment Links

Reach a wider audience by sending pay links via SMS or Email

Gain real-time insights into payment status

Encourage a shift towards cashless transactions

Tokenization & Vault

Reduces scope of data breaches and fraud

Helps businesses adhere to industry standards like PCI DSS

Manage customer payment details effectively

Why Choose Nilon?

As the market continues to expand, businesses require a reliable and secure payment solution.

Nilon enables your business to accept instant and secure payments across all verticals, including online, mobile, and in-store.

Security and Compliance

Values security measures and 100% regulatory compliance to protect every transaction.

Flexible Technology

Leverage the latest payment trends and provide your customers with innovative payment solutions.

Omnichannel Payments

Unified platform for accepting card-present and card-not-present payments across multiple channels.

Mobile Payments

Provides businesses and customers with the flexibility of enabling safe, on-the-go transactions.

E-commerce Payments

Multiple payment ways for customers to pay for goods and services when shopping online.

Recurring Payments

Easily set up & manage recurring payments, payment plans, and automatic billing for your customers.

Manage your day-to-day operations more effectively and acquire new customers

Creating opportunities for businesses to access the full spectrum of payment solutions they need to run their business.

Easy Payment Integration

Streamlined APIs and SDKs

Save developers time with our unified payments functionality. Our APIs provide a prebuilt SaaS payment platform that allows you to accept payments instantly.

Get Started

Connect with our team, and they will assist you in establishing the optimal payment solution for your business. And feel free to experiment with our sandbox to explore its functionality.

API Integration

Integrate Now

Explore our API and experience user-friendly payment integrations.

Get To know Us

Connect With Us

650-709-2400

team@Nilon.com

656 Quince Orchard Rd. Suite 300 Gaithersburg, MD 20878