Driving Business Growth with Streamlined Transactions

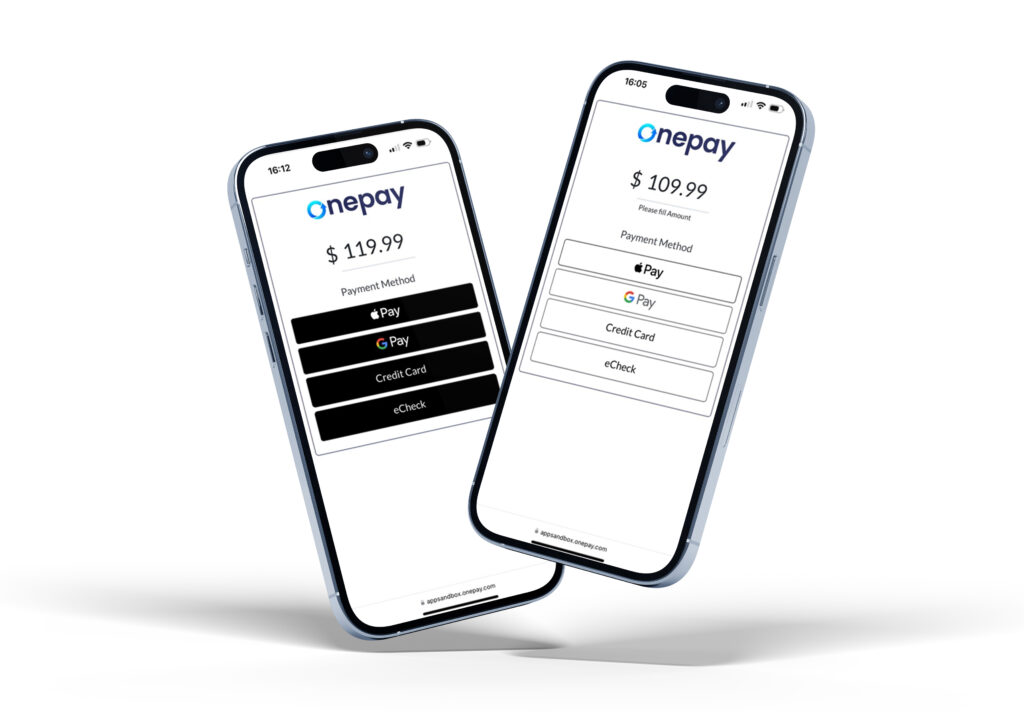

Whether accepting payments in person or online, providing various payment options like Apple Pay, Google Pay, Credit Cards/Debit Cards and other digital methods enhances convenience for both businesses and customers. By implementing digital payment solutions, small businesses can offer the customers with their evolving preference and maintain a competitive edge in today’s cashless payments era.

Offering diverse payment methods goes beyond just technology adoption—it’s about meeting customers’ demands for convenience, making transactions smoother and more accessible in every way.

Technologies like tap-to-pay and click-to-pay are transforming the way businesses conduct transactions, making payment processes faster, more convenient, and more secure.

Seamless Payments with Digital Payments

Nilon is at the forefront of this transformation, offering businesses the tools they need to integrate digital payments seamlessly into their payment systems. By leveraging Nilon’s advanced technology, companies can provide customers with the convenience and security they demand, ensuring smoother transactions and fostering stronger customer loyalty in a cashless economy.

Top Digital Payment Methods Americans Prefer in 2024

The most preferred digital payments for Americans in 2024 include:

Apple Pay is the most dominant and widespread digital wallet on the market, known for its seamless integration across Apple devices and its strong focus on security. Supported by a vast network of banks and merchants globally, Apple Pay payments has become a preferred choice for millions, solidifying its position as a leader in the digital payment space.

Nilon complements this dominance by offering businesses the ability to easily integrate Apple Pay into their payment solutions. With Nilon’s advanced platform, businesses and merchants can ensure they’re catering to the growing number of consumers who prefer Apple Pay, enhancing customer experience and staying ahead in the competitive digital payment landscape.

Google Wallet/ Google Pay

Google Pay is a leading digital payment known for its extensive integration across Android devices and a wide range of payment services. With its strong focus on convenience and security, Google Payment has quickly become a popular choice for millions of users worldwide, supporting a wide range of payment options for both online and in-store transactions, ensuring convenience and broad acceptance.

Nilon enhances this experience by offering businesses an easy way to integrate Google Pay into their payment solutions. With Nilon’s robust platform, companies can meet the demands of the growing number of consumers who prefer Google Pay app for payments, improving customer satisfaction and maintaining a competitive edge in the digital payment market.

Credit Cards/Debit Cards:

Credit and Debit Cards are fundamental payment methods known for their widespread use and versatility. These cards provide users with a straightforward way to make both online and in-store purchases, offering immediate access to funds and a high level of security

Nilon completes this by enabling businesses to efficiently process credit and debit card payments through its advanced platform. By integrating Nilon’s solutions, companies can cater to the extensive use of these cards, ensuring smooth and secure transactions that enhance customer satisfaction and support businesses and merchants’ growth in the competitive payment landscape.

What Are the Benefits of Digital Payments?

What Benefits Do Digital Payments Offer Consumers?

- Convenience: A digital wallet can hold an unlimited number of cards. The average American now has 3.84 credit cards, not including their numerous debit and loyalty cards. The ability to tap or click to pay is convenient for shoppers since they don’t have to carry a bulky wallet.

- Speed: In-store, these payments are as fast as tapping a contactless credit or debit card. Online, paying is often a one-click process that eliminates the need to enter payment details. That makes this solution one of the fastest payment methods available.

- Security: Most in-store digital payments with a smartphone require multi-factor authentication, such as biometric verification, which adds an extra layer of security. This makes it much harder for bad actors to use stored payment information on stolen phones.

What Benefits Do Digital Payments Offer Merchants?

For merchants, accepting digital payments reduces costly payments fraud and ensures consumers have additional ways to pay.

- Consumer Choice: Today’s consumers want to choose how and when they interact with businesses. If their needs aren’t met, they’ll go somewhere else. Research from Gartner shows that a majority of millennial and Gen Z consumers would stop buying from a company if they couldn’t access the self-service options they wanted. For merchants, digital payments are an effective and easily accessible way to stay competitive by providing consumers with a broader set of payment choices.

- Fraud Prevention: Although not foolproof, the additional security this method offers means merchants won’t have to worry as much about taking payments from stolen cards or receiving illegitimate charge disputes. Ultimately, the more digital payments transactions a merchant takes, the lower their fraud risk gets.