Going Live with Apple Pay

The Digital Transformation of Payments

The world of payments is undergoing a progressive transformation. With the rise of multiple online payment options, customers are increasingly seeking faster, more secure ways to pay—whether they’re making e-commerce payments or completing transactions in-store. Apple Pay has emerged as a leader in this space, offering users a seamless, secure payment systems, and private way to pay that aligns perfectly with modern consumer expectations.

At Nilon, we recognize the crucial importance of staying ahead of these trends. Our decision to integrate Apple Pay is not merely a response to market demand; it’s a strategic initiative designed to encourage our merchants to thrive in an environment where convenience and security are of utmost priority. By integrating with Apple Pay, we’re equipping our merchants with the tools they need to meet the needs of today’s tech- savvy consumers while positioning them to leverage new growth opportunities.

The Apple Pay Advantage

Did you know?

As of 2023, 507 million people globally were using Apple Pay. This represents significant growth, given that the service was launched in 2014. Apple Pay is available in over 60 countries.

Apple Pay has become more than just a contactless payment option; it’s a comprehensive payment ecosystem that combines advanced technology with user-centric design. For consumers, it offers an intuitive and secure way to pay using their iPhone, iPad, Apple Watch, or Mac. Transactions are quick, contactless, and protected by multiple layers of security, including multiple factor authentication and tokenization.

What This Means for Our Merchants?

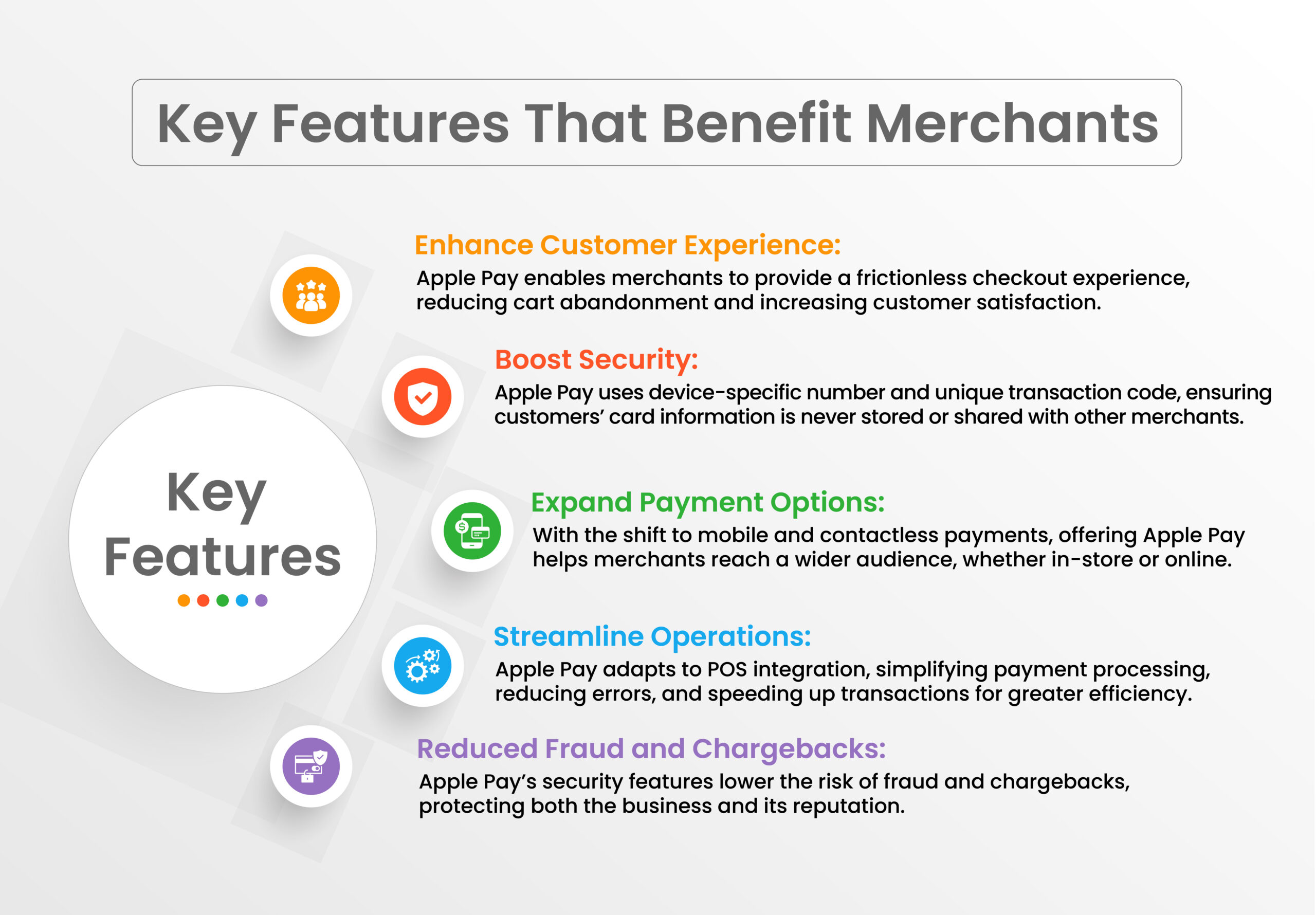

Key Features That Benefit Merchants